Why Automattic's Valuation was Flat

Last May some of Automattic's early shareholders sold some shares to Tiger Global at a valuation of about $1B according to Fortune:

The San Francisco-based company declined to discuss valuation, but a source familiar with the situation says that Tiger valued Automattic "just below" the $1.1 billion price-tag that Yahoo (YHOO) recently bestowed upon Tumblr.

This week Matt Mullenweg announced an investment of $160 million at the same pre-money valuation of $1B. Why no increase in the valuation from last year?

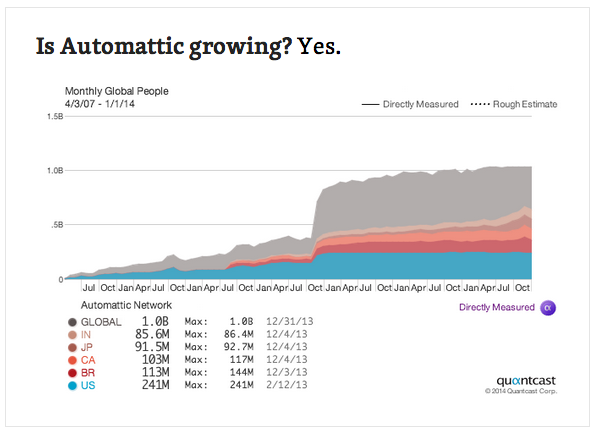

Current market conditions aside, this chart (assuming it's correct) on Automattic.com is probably the best explanation for why the valuation was flat:

Matt Mullenweg is hoping the new funding will allow the company to grow faster:

It was also only a year ago I said “Automattic is healthy, generating cash, and already growing as fast as it can so there’s no need for the company to raise money directly — we’re not capital constrained.”

I was wrong, but I didn’t realize it until I took on the CEO role in January. Things were and are going well, but there was an opportunity cost to how we were managing the company toward break-even, and we realized we could invest more into WordPress and our products to grow faster. Also our cash position wasn’t going to be terribly strong especially after a number of infrastructure and product investments this and last year.

About TheStartup100

TheStartup100 and this blog are a project of Frank Anderson. I'm an internet entrepreneur; former investment banker and consultant; and studied at the University of Illinois and the University of Chicago. You can email me at frank(at)thestartup100.com.