Venture capital investment triples in January, 2015

The data below is for US-based companies with over $500K in funding, and is limited to investments by the top 500 venture capital firms (as measured by number of investments).

All source data in the charts below is available on TheStartup100.</font size="3">

Venture capital investment triples in January, 2015

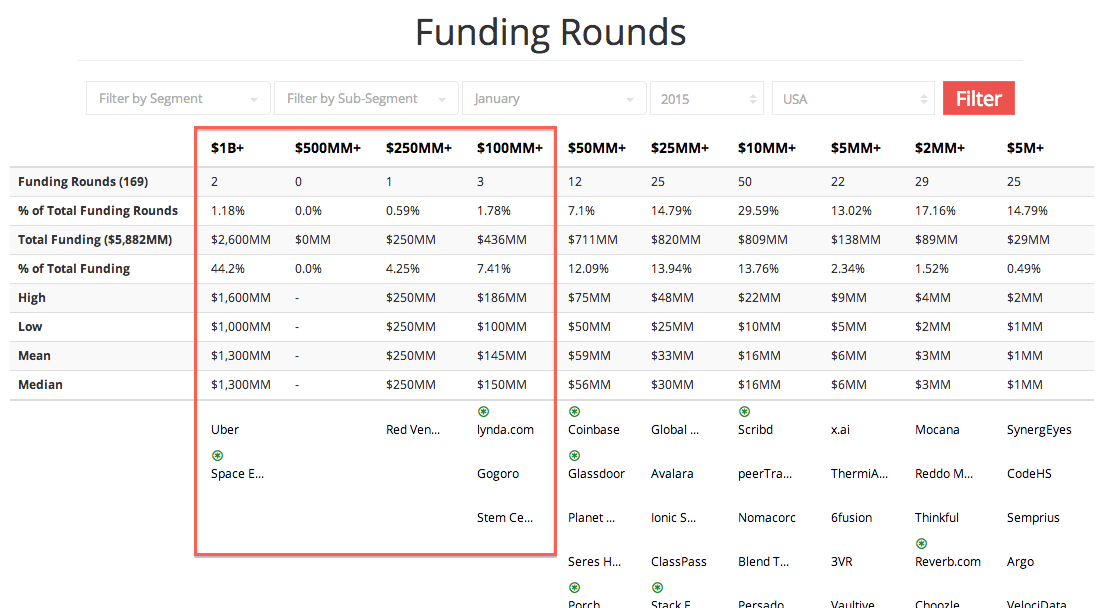

With one week remaining in January, US venture capital invesment is already triple January, 2014 investment at $5.8 billion vs. $1.9 billion (on 164 investments vs. 174 in January, 2014).

A big increase in large funding rounds accounts for the increase. Last year at this time there were only two funding rounds worth over $100 million for a total value of $300 million in funding. So far this year there have been six funding rounds worth more than $100 million for a total value of $3.3 billion, led by the $1.6B Uber funding round and the $1.0 billion SpaceX funding round.

You can find an interactive version of this chart on TheStartup100.

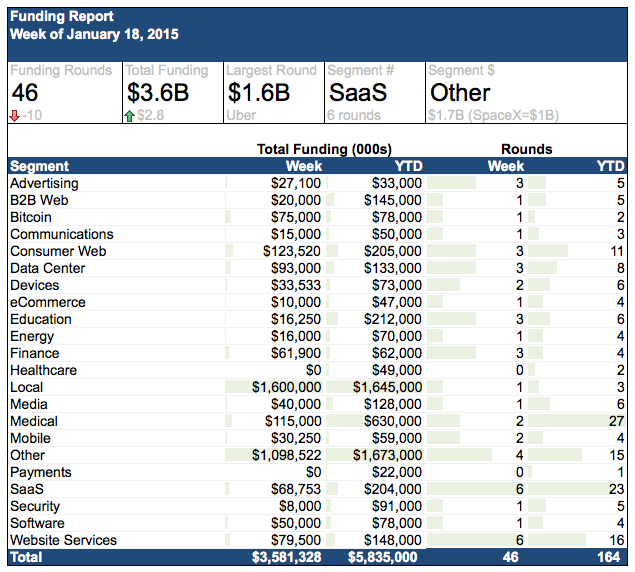

The Week: 46 funding rounds worth $3.6B

The Uber and SpaceX rounds ($2.6B combined) accounted for about 70% of total funding.

Notable

- SaaS funding is off to a slow start with 23 rounds and $204 million in total funding vs. 35 rounds and $227 million in January, 2014. Avalara, a sales tax compliance solution, raised $42 million for the largest round year-to-date. Browse all SaaS fundings here.

- Year-to-date funding in Education looks high at $212 million, but $186 million is the Lynda.com funding round.

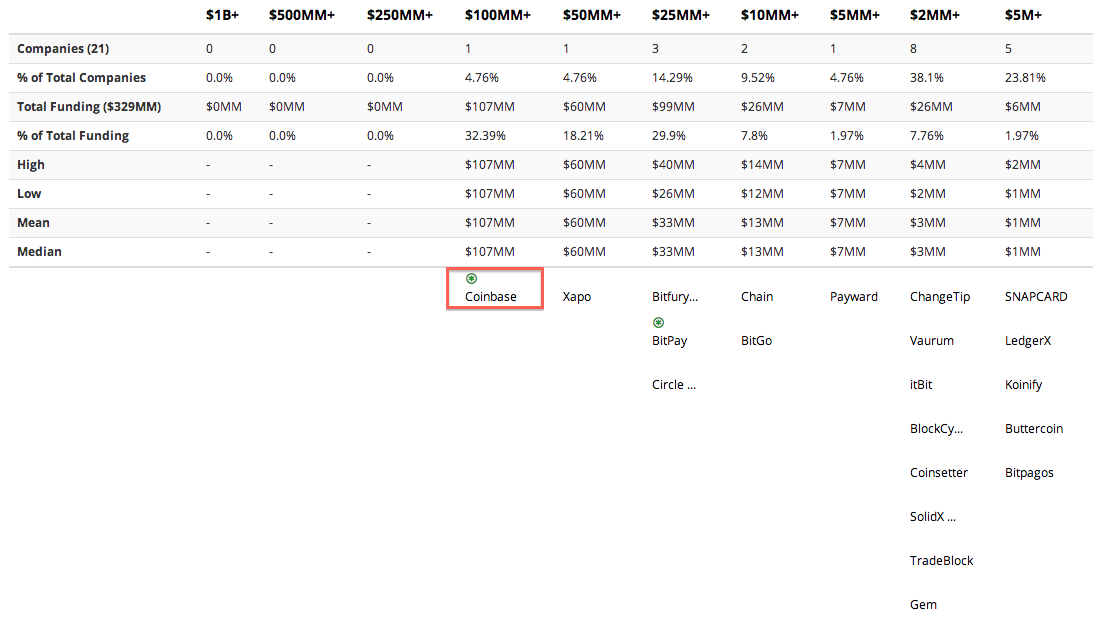

- With its $75 million funding round, Coinbase became the first Bitcoin company to reach $100MM in funding.